Instructions to students:

- This is a group work.

- You are required to work in a group of four.

- The assignment should be written in your own words.

- Word count: 2000 words. You may go above or below the word limit by 10%.

- Total marks: 20 marks

- No hard copy is required.

Task: MA613 Tax Concessions For Small Businesses Assignment

Assignment Description:

Tax Concessions for Small Businesses in Australia

The taxation law has provided various special treatments to small businesses in order to relief their tax burdens. For example, tax rates for small resident businesses and CGT relief (Division 152 of ITAA97, textbook p. 327). You are required to summarise all the tax concessions that you may possibly identify for small businesses in Australia. Please demonstrate your arguments by an example.

Your group essay MUST identify the relevant legislation, cases and tax rulings.

Presentation:

Readable connected prose NOT point form summaries

- Accurate spelling, grammar, punctuation, paragraph construction and proofreading is required.

- Effective use of HEADINGS if appropriate.

- Consistent and accurate acknowledgment of sources using a recognised style – both in relation to in-text referencing and footnoting.

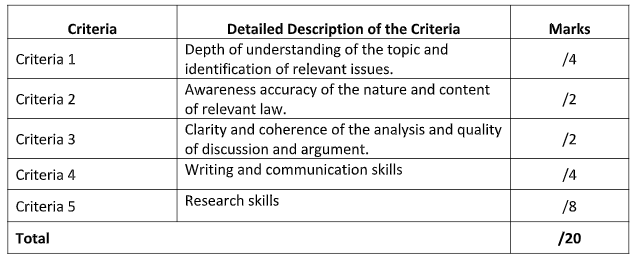

Marking Criteria: MA613 Tax Concessions For Small Businesses Assignment-Melbourne Institute of Technology, Australia

The marking criteria is shown in following table. Marks are allocated as follows:

ORDER This MA613 Tax Concessions For Small Businesses Assignment NOW And Get Instant Discount

Get Income Tax Law And Practice Assignment written by professionals